- Bank Name

- L&T FINANCE

- Loss Amount

- 2600000

- Ratings

- 5.00 star(s)

I feel compelled to share my deeply disappointing experience with L&T Finance in the hope that others can make better-informed decisions when selecting a home loan provider.

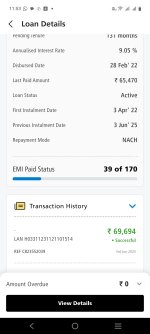

On 28-Feb-2022, I availed a housing loan from L&T Finance under LAN ID: H03311231121101514 at a steep interest rate of 9.05%. Over the past three years, despite the RBI reducing policy rates multiple times, L&T Finance never revised or reduced my loan interest rate. As a result, I have already paid more than ₹26 lakhs in interest alone, burdened by unusually high EMIs that stretched my financial limits.

I reached out numerous times requesting a downward revision, but to no avail. The response from their customer service was dismissive, if not apathetic. It’s disheartening to see such indifference and rigidity from a reputed financial institution, especially when many other banks have adjusted their rates to align with RBI’s policies and offer relief to customers.

Let this be a warning to anyone considering a home loan from L&T Finance. My advice: Do your due diligence. Compare interest rates, assess customer service, and understand your options thoroughly. Because once you’re locked in, the cost could be far greater than you anticipated—not just financially, but emotionally too.

I have now taken the decision to shift my loan to another bank offering more customer-friendly and RBI-compliant rates. While it hurts to know how much I’ve already paid, I sincerely hope my experience helps others avoid the same mistake.

*However I am still ready to continue with L&T if they revised my loan interest rates to 7.3% , reduce the tenure and EMI amount*

Let’s raise awareness so that institutions are held accountable, and borrowers are empowered to ask the right questions before signing on the dotted line.

On 28-Feb-2022, I availed a housing loan from L&T Finance under LAN ID: H03311231121101514 at a steep interest rate of 9.05%. Over the past three years, despite the RBI reducing policy rates multiple times, L&T Finance never revised or reduced my loan interest rate. As a result, I have already paid more than ₹26 lakhs in interest alone, burdened by unusually high EMIs that stretched my financial limits.

I reached out numerous times requesting a downward revision, but to no avail. The response from their customer service was dismissive, if not apathetic. It’s disheartening to see such indifference and rigidity from a reputed financial institution, especially when many other banks have adjusted their rates to align with RBI’s policies and offer relief to customers.

Let this be a warning to anyone considering a home loan from L&T Finance. My advice: Do your due diligence. Compare interest rates, assess customer service, and understand your options thoroughly. Because once you’re locked in, the cost could be far greater than you anticipated—not just financially, but emotionally too.

I have now taken the decision to shift my loan to another bank offering more customer-friendly and RBI-compliant rates. While it hurts to know how much I’ve already paid, I sincerely hope my experience helps others avoid the same mistake.

*However I am still ready to continue with L&T if they revised my loan interest rates to 7.3% , reduce the tenure and EMI amount*

Let’s raise awareness so that institutions are held accountable, and borrowers are empowered to ask the right questions before signing on the dotted line.

Last edited: