Mehali Dey

New member

- Bank Name

- Profin Finance Private Limited and Axis Finance Limited

- Customer Care Number

- 7975412291

- Loss Amount

- 1216175

- Ratings

- 1.00 star(s)

- Opposite Party Address

- Profin Finance Private Limited (CIN: U08031KA1988PTC009709) in Bangalore is NO. 802, II FLOOR, VINAYCOMPLEX, CHICKPET COMPLEX, CHICKPET, BANGALORE.

Axis Finance Limited-Ground & 1st Floor, Alpha Centre-216, Double Road, 2nd Stage, Indiranagar, Bangalore-560038, Karnataka

I have been a victim of a fraudulent loan case involving Profin Finance Private Limited and Axis Finance Limited

I was looking for a loan of INR 4 lakhs. On 14th Nov 2025, I received a call from Lubna Banu (7975412291), email ID lubnabanu6264@gmail.com, from Profin Finance. She discussed my loan requirement, and I was told that my file had been forwarded to Axis Finance for further documentation and approval.

After that, Lubna did not responded for a few days. Then, on 28th Nov, she informed me that she was unable to get approval from Axis Finance for the 4-lakh loan. She then suggested doing a balance transfer of my existing HDFC Bank loan. Since I urgently needed the loan, I agreed. However, the rate of interest was still not confirmed, and she asked me to share my HDFC loan repayment statement, which I provided. After that, she informed me that my loan had been approved for INR 12 lakhs and told me that I would receive a DD for the HDFC loan balance transfer amount of INR 8,40,900 and the CRED App loan amount of INR 51,281, and that the remaining amount would be disbursed to my account.

Later, the rate of interest was disclosed as 13.5%, which is much higher than the interest rate on my existing loan which is 10%. Additionally, only INR 2,86,142 was disbursed into my account on 1st Dec’25, instead of the INR 4 lakhs that I originally required.

Lubna never clarified the exact amount that I would receive in my account. She only mentioned that it would be slightly less than my expectation, around INR 3,80,000. She also never asked me for the HDFC LOAN FORECLOSURE STATEMENT, Instead, she coordinated directly with the Axis Finance RM, Pavan Kumar (9035603488, pavan35.kumar@axisfinance.in), who prepared the DD based on the repayment statement and sent it to me.

When I went to HDFC Bank to submit the DD, I was asked to pay Rs. 46,565 as foreclosure charges, which was out of my financial capacity. It was never informed to me by either Lubna from Profin Finance or Pavan Kumar, the RM from Axis Finance on the foreclosure charges. When I tried reaching out to both for clarification, they denied any responsibility and stated that they were not accountable for this.

Since then, I have not received any support from either party. I went to the Axis Finance loan branch in Indiranagar to cancel the DD for the HDFC loan balance transfer amount of INR 8,40,900., Pavan Kumar, the RM from Axis Finance, instructed me to submit the DD to his colleague, Anita, and I sent mail also for the same to Pavan Kumar’s Email ID. However, they are now refusing to cancel the DD and are asking me to bear the foreclosure charges payable to HDFC Bank, or else cancel the entire loan.

At the moment, both options are not possible as, due to insufficient funds, I am unable to pay the foreclosure charges to HDFC Bank. After receiving the balance amount of INR 2,86,142, I cleared my credit card dues and am now left with very limited funds Now, I am stuck in a situation where neither Axis Finance is cancelling my DD for the HDFC Bank Balance Transfer Loan, nor are they willing to amend the loan contract.

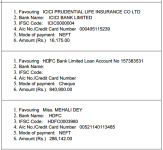

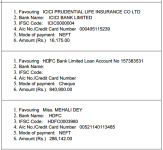

I’m in loss of Rs. 46,565/- (HDFC Foreclosure Processing Fees) + Rs.16,175.00/- (ICICI PRUDENTIAL LIFE INSURANCE CO LTD) + Rs. 21,677.00- (PROCESSING FEE) =

TOTAL-INR 84,417/-.

Due to insufficient information provided and the DD being issued without collecting the proper documents, I am incurring a significant loss.

Below is the table for more clarity-

Now, as per Axis Finance, they are insisting that I pay Rs. 46,565/- (HDFC foreclosure processing fees) to proceed with the balance transfer. Otherwise, they will process a part payment with the approved loan amount of Rs. 12,16,175/- without making any changes to the existing loan documents. This will be done next month after deducting the first EMI of Rs. 27,984.

This means that in January 2026, two EMIs will be deducted: Rs. 21,693/- to HDFC for the existing loan and Rs. 27,984/- to Axis Finance, totalling Rs. 49,677/-. I will not be able to bear this amount, as it will make impossible to manager my basic needs also on my salary.

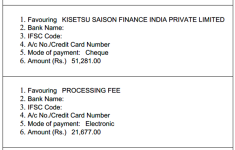

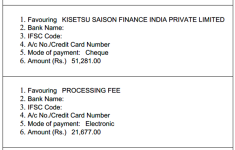

Or cancel whole Loan amount by returning the Amount disbursed in my account -INR 286,142.00 + 51,281.00 (DD which I already submitted to KISETSU SAISON FINANCE INDIA PRIVATE LIMITED) =TOTAL- Rs.3,37,423/-.

I feel that the entire incident is unfair, and I believe I have been defrauded by both Profin Finance Private Limited and Axis Finance Limited. Insufficient information was provided to me, and the DD was issued without collecting the proper documents. Now, both parties are denying their responsibility and displaying highly unprofessional and unsupportive behavior.

While I also asked Lubna from Profin to pass her manager’s number to escalate, she denied stating that it is not her Company’s policy.

Currently, I am undergoing a medical treatment as well which puts me in a more difficult situation.

I would request you to please look into this as a matter of urgency and help me with the resolution.

Looking forward!

Regards,

Mehali Dey

mehali.dey11@gmail.com

I was looking for a loan of INR 4 lakhs. On 14th Nov 2025, I received a call from Lubna Banu (7975412291), email ID lubnabanu6264@gmail.com, from Profin Finance. She discussed my loan requirement, and I was told that my file had been forwarded to Axis Finance for further documentation and approval.

After that, Lubna did not responded for a few days. Then, on 28th Nov, she informed me that she was unable to get approval from Axis Finance for the 4-lakh loan. She then suggested doing a balance transfer of my existing HDFC Bank loan. Since I urgently needed the loan, I agreed. However, the rate of interest was still not confirmed, and she asked me to share my HDFC loan repayment statement, which I provided. After that, she informed me that my loan had been approved for INR 12 lakhs and told me that I would receive a DD for the HDFC loan balance transfer amount of INR 8,40,900 and the CRED App loan amount of INR 51,281, and that the remaining amount would be disbursed to my account.

Later, the rate of interest was disclosed as 13.5%, which is much higher than the interest rate on my existing loan which is 10%. Additionally, only INR 2,86,142 was disbursed into my account on 1st Dec’25, instead of the INR 4 lakhs that I originally required.

Lubna never clarified the exact amount that I would receive in my account. She only mentioned that it would be slightly less than my expectation, around INR 3,80,000. She also never asked me for the HDFC LOAN FORECLOSURE STATEMENT, Instead, she coordinated directly with the Axis Finance RM, Pavan Kumar (9035603488, pavan35.kumar@axisfinance.in), who prepared the DD based on the repayment statement and sent it to me.

When I went to HDFC Bank to submit the DD, I was asked to pay Rs. 46,565 as foreclosure charges, which was out of my financial capacity. It was never informed to me by either Lubna from Profin Finance or Pavan Kumar, the RM from Axis Finance on the foreclosure charges. When I tried reaching out to both for clarification, they denied any responsibility and stated that they were not accountable for this.

Since then, I have not received any support from either party. I went to the Axis Finance loan branch in Indiranagar to cancel the DD for the HDFC loan balance transfer amount of INR 8,40,900., Pavan Kumar, the RM from Axis Finance, instructed me to submit the DD to his colleague, Anita, and I sent mail also for the same to Pavan Kumar’s Email ID. However, they are now refusing to cancel the DD and are asking me to bear the foreclosure charges payable to HDFC Bank, or else cancel the entire loan.

At the moment, both options are not possible as, due to insufficient funds, I am unable to pay the foreclosure charges to HDFC Bank. After receiving the balance amount of INR 2,86,142, I cleared my credit card dues and am now left with very limited funds Now, I am stuck in a situation where neither Axis Finance is cancelling my DD for the HDFC Bank Balance Transfer Loan, nor are they willing to amend the loan contract.

I’m in loss of Rs. 46,565/- (HDFC Foreclosure Processing Fees) + Rs.16,175.00/- (ICICI PRUDENTIAL LIFE INSURANCE CO LTD) + Rs. 21,677.00- (PROCESSING FEE) =

TOTAL-INR 84,417/-.

Due to insufficient information provided and the DD being issued without collecting the proper documents, I am incurring a significant loss.

Below is the table for more clarity-

Now, as per Axis Finance, they are insisting that I pay Rs. 46,565/- (HDFC foreclosure processing fees) to proceed with the balance transfer. Otherwise, they will process a part payment with the approved loan amount of Rs. 12,16,175/- without making any changes to the existing loan documents. This will be done next month after deducting the first EMI of Rs. 27,984.

This means that in January 2026, two EMIs will be deducted: Rs. 21,693/- to HDFC for the existing loan and Rs. 27,984/- to Axis Finance, totalling Rs. 49,677/-. I will not be able to bear this amount, as it will make impossible to manager my basic needs also on my salary.

Or cancel whole Loan amount by returning the Amount disbursed in my account -INR 286,142.00 + 51,281.00 (DD which I already submitted to KISETSU SAISON FINANCE INDIA PRIVATE LIMITED) =TOTAL- Rs.3,37,423/-.

I feel that the entire incident is unfair, and I believe I have been defrauded by both Profin Finance Private Limited and Axis Finance Limited. Insufficient information was provided to me, and the DD was issued without collecting the proper documents. Now, both parties are denying their responsibility and displaying highly unprofessional and unsupportive behavior.

While I also asked Lubna from Profin to pass her manager’s number to escalate, she denied stating that it is not her Company’s policy.

Currently, I am undergoing a medical treatment as well which puts me in a more difficult situation.

I would request you to please look into this as a matter of urgency and help me with the resolution.

Looking forward!

Regards,

Mehali Dey

mehali.dey11@gmail.com