- Policy Name

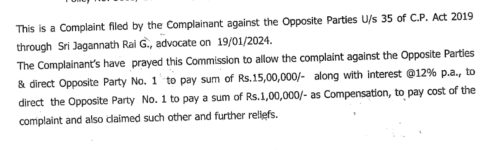

- OG-25-1301-843300000069

- Company Name

- Bajaj Allianz general insurance company

- Customer Care Number

- 1800-103-2529

- Loss Amount

- 30000

- Ratings

- 1.00 star(s)

- Opposite Party Address

- Bajaj Allianz general insurance company

3 floor Narain Building

shanajhaf road

hazratganj- Lucknow

226001

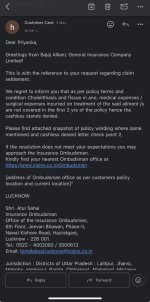

Dear sir,

This is to inform you that, I am a health policy holder of Bajaj Aliance Company with family floater plan ( policy Numbers- OG-25-1301-843300000069)

As on 27.03.2025 I got admitted at Ajanta Hospital due to food poisoning( loose motions) by 3:00 am.

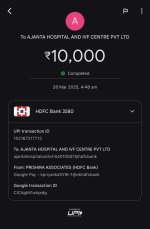

I got admitted in emergency initially sample was taken for further diagnostic where I have been asked to deposit 10k initially as admission fees..after that i have shown my insurance card to further process and approvals.

I have been shifted to the semi private room same day where and after all the diagnostic reports next day I have been diagnosed with typhoid,diarrhoea and with the gall stone in ultrasound reports.

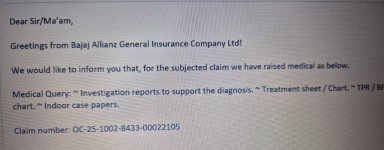

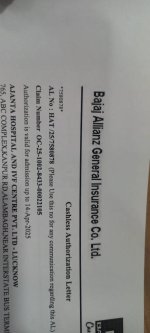

My all the reports and estimate of my treatment shared with the tpa as well as the Bajaj teams on the basis of that they have approved the request and grant to the initial Rs.15000/- approval to continue the treatment message received on 30/03/2025 at 8:59 pm( Dear Customer, We are in receipt of your cashless request at 08:52 PM vide claim ID 7580878 from AJANTA HOSPITAL AND IVF CENTRE PVT. LTD - LUCKNOW. Please quote the Claim ID in all your communications with us. If you have any concerns, please call 1800-103-2529. Caringly yours -Bajaj Allianz GIC )

After my recovery as per doctor I have to discharge from hospital on 01/04/2025 by 2:30 pm but due to carelessness of Bajaj I got the mail by 11:30 pm although that to after 50 follow up with agent and team and they have denied my approval with the excuse of the gall stone but as per the doctor and hospital i have been only treated for my diarrhoea and typhoid in the utra sound i have been only diagnosed with the non of the treatment was take for stone.The hospital not allowed me to totally harassed me for the payment I borrowed the money the do the pay of Rs.20504/- paid more to the hospital (10000+20504=Rs.30,504) on 02.04.2025 by 12:40 am

Sir, I have now I failed to understand that where the initial approval for 15000/- came from where there is also the all the reports was mention although the hospital himself separately mention on his personal letterhead that the treatment was only given for diarrhoea and typhoid only and no other investigation done by hospital part.

I have been going piller to post spoken 10 people in Bajaj but no response from them.

Iam written to with hope and humble request to please call up the matter and obliged.

All the documents are attached for your reference plz have a look and do the needful.

Priyanka Kanojia

Lucknow

This is to inform you that, I am a health policy holder of Bajaj Aliance Company with family floater plan ( policy Numbers- OG-25-1301-843300000069)

As on 27.03.2025 I got admitted at Ajanta Hospital due to food poisoning( loose motions) by 3:00 am.

I got admitted in emergency initially sample was taken for further diagnostic where I have been asked to deposit 10k initially as admission fees..after that i have shown my insurance card to further process and approvals.

I have been shifted to the semi private room same day where and after all the diagnostic reports next day I have been diagnosed with typhoid,diarrhoea and with the gall stone in ultrasound reports.

My all the reports and estimate of my treatment shared with the tpa as well as the Bajaj teams on the basis of that they have approved the request and grant to the initial Rs.15000/- approval to continue the treatment message received on 30/03/2025 at 8:59 pm( Dear Customer, We are in receipt of your cashless request at 08:52 PM vide claim ID 7580878 from AJANTA HOSPITAL AND IVF CENTRE PVT. LTD - LUCKNOW. Please quote the Claim ID in all your communications with us. If you have any concerns, please call 1800-103-2529. Caringly yours -Bajaj Allianz GIC )

After my recovery as per doctor I have to discharge from hospital on 01/04/2025 by 2:30 pm but due to carelessness of Bajaj I got the mail by 11:30 pm although that to after 50 follow up with agent and team and they have denied my approval with the excuse of the gall stone but as per the doctor and hospital i have been only treated for my diarrhoea and typhoid in the utra sound i have been only diagnosed with the non of the treatment was take for stone.The hospital not allowed me to totally harassed me for the payment I borrowed the money the do the pay of Rs.20504/- paid more to the hospital (10000+20504=Rs.30,504) on 02.04.2025 by 12:40 am

Sir, I have now I failed to understand that where the initial approval for 15000/- came from where there is also the all the reports was mention although the hospital himself separately mention on his personal letterhead that the treatment was only given for diarrhoea and typhoid only and no other investigation done by hospital part.

I have been going piller to post spoken 10 people in Bajaj but no response from them.

Iam written to with hope and humble request to please call up the matter and obliged.

All the documents are attached for your reference plz have a look and do the needful.

Priyanka Kanojia

Lucknow

Attachments

-

WhatsApp Image 2025-05-17 at 11.13.20 PM (1).jpeg93.5 KB · Views: 1

WhatsApp Image 2025-05-17 at 11.13.20 PM (1).jpeg93.5 KB · Views: 1 -

WhatsApp Image 2025-05-17 at 11.13.20 PM.jpeg53.6 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.13.20 PM.jpeg53.6 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.13.19 PM (2).jpeg54 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.13.19 PM (2).jpeg54 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.13.19 PM (1).jpeg103.8 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.13.19 PM (1).jpeg103.8 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.13.19 PM.jpeg42.8 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.13.19 PM.jpeg42.8 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.13.18 PM.jpeg177 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.13.18 PM.jpeg177 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.30.50 PM.jpeg56.4 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.30.50 PM.jpeg56.4 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.29.49 PM.jpeg55.5 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.29.49 PM.jpeg55.5 KB · Views: 0 -

WhatsApp Image 2025-05-17 at 11.29.19 PM.jpeg90.3 KB · Views: 0

WhatsApp Image 2025-05-17 at 11.29.19 PM.jpeg90.3 KB · Views: 0