Anurag Sharma

New member

- Policy Name

- HDFC Life Click 2 Protect Super (Spl)

- Company Name

- HDFCLife

- Customer Care Number

- 1800 1600

- Loss Amount

- 23648

- Ratings

- 1.00 star(s)

- Opposite Party Address

- HDFC Bank opposite Teri Gram, near shiv Mandir, Fardabad Gurgaon Expresway

I am writing this to formally register a serious grievance against HDFC Bank and its representatives regarding the mis-selling and subsequent misrepresentation of a term insurance policy sold to me on 28th April 2025.

I was assured that the policy would cover a sum insured of ₹1 crore and include Accidental Benefit Riders with the following clearly promised features:

Despite this assurance, the bank is now denying these rider benefits, stating that a higher premium is required, which was never communicated at the time of sale.

I have repeatedly raised this issue with:

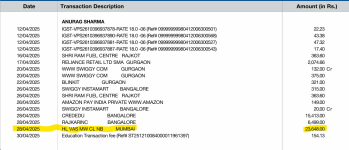

Till date, no resolution has been provided, and I have been made to follow up for over 24 days. The premium was deducted on the same day (₹ 23648 via my HDFC Millennia Credit Card), and I have not received the final policy document with the agreed-upon benefits. And for these 24 days I was not covered as per the purchase terms, leaving the whole concept vulnerable.

Now, I am being coerced into a cancellation process with a warning that I will not be eligible for any insurance for the next 6 months—a completely unjust and harassing stance, especially when the mis-selling occurred from HDFC's side.

I am also escalating this matter to the Insurance Regulatory and Development Authority of India (IRDAI) and the Banking Ombudsman as there was no resolution provided in the last 20 working days.

Attached are screenshots/emails related to the initial communication and sales assurances made.

Kindly treat this matter as urgent and provide me the resolution for the same.

I was assured that the policy would cover a sum insured of ₹1 crore and include Accidental Benefit Riders with the following clearly promised features:

- Accidental Death Benefit: The sum insured would be doubled in case of accidental death.

- Accidental Disability Benefit: In case of accidental disability, I would receive 1% of the sum insured (₹1 lakh) every year as compensation.

Despite this assurance, the bank is now denying these rider benefits, stating that a higher premium is required, which was never communicated at the time of sale.

I have repeatedly raised this issue with:

- Mr. Rahul Qurasi (Relationship Manager) – rahul.qurasi@hdfcbank.com

- Mr. Sahil Aggarwal (Sales Representative) – sahil.aggarwal@hdfclife.in | +91-9868171595

- HDFC Bank customer care

Till date, no resolution has been provided, and I have been made to follow up for over 24 days. The premium was deducted on the same day (₹ 23648 via my HDFC Millennia Credit Card), and I have not received the final policy document with the agreed-upon benefits. And for these 24 days I was not covered as per the purchase terms, leaving the whole concept vulnerable.

Now, I am being coerced into a cancellation process with a warning that I will not be eligible for any insurance for the next 6 months—a completely unjust and harassing stance, especially when the mis-selling occurred from HDFC's side.

I am also escalating this matter to the Insurance Regulatory and Development Authority of India (IRDAI) and the Banking Ombudsman as there was no resolution provided in the last 20 working days.

Attached are screenshots/emails related to the initial communication and sales assurances made.

Kindly treat this matter as urgent and provide me the resolution for the same.