ankitakhanna

New member

- Bank Name

- American Express

- Loss Amount

- 1474636

- Ratings

- 1.00 star(s)

I am holding an American Express credit card ending with XX1008.

Over the past months, I have already paid more than ₹6.3 lakhs only as finance charges/interest to American Express. Despite this, my outstanding dues keep increasing instead of reducing (from approx. ₹8.3 lakhs to ₹8.6 lakhs).

I approached American Express multiple times requesting relief in the form of restructuring or conversion of the principal (₹1–2 lakhs) into affordable EMIs. However, I was informed by their representatives that American Express has paused all financial relief/hardship plans in India.

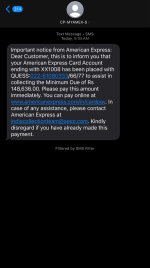

Instead of providing a resolution, their staff kept delaying my case under the pretext of “escalations” and eventually transferred my account to a third-party collection agency QUESS (notice received on 29th August 2025). I was asked to borrow money from other banks to clear their dues, which is unfair, coercive, and against RBI’s Fair Practices Code.

American Express is a regulated NBFC under RBI and is required to treat customers fairly. Pausing financial relief/restructuring options while continuing to levy heavy finance charges is a clear case of deficiency in service and unfair trade practice.

Relief Sought:

I request the Consumer Forum to kindly intervene and direct American Express to provide me fair restructuring, stop harassment through third-party collectors, and ensure justice in line with RBI’s regulations.

Over the past months, I have already paid more than ₹6.3 lakhs only as finance charges/interest to American Express. Despite this, my outstanding dues keep increasing instead of reducing (from approx. ₹8.3 lakhs to ₹8.6 lakhs).

I approached American Express multiple times requesting relief in the form of restructuring or conversion of the principal (₹1–2 lakhs) into affordable EMIs. However, I was informed by their representatives that American Express has paused all financial relief/hardship plans in India.

Instead of providing a resolution, their staff kept delaying my case under the pretext of “escalations” and eventually transferred my account to a third-party collection agency QUESS (notice received on 29th August 2025). I was asked to borrow money from other banks to clear their dues, which is unfair, coercive, and against RBI’s Fair Practices Code.

American Express is a regulated NBFC under RBI and is required to treat customers fairly. Pausing financial relief/restructuring options while continuing to levy heavy finance charges is a clear case of deficiency in service and unfair trade practice.

Relief Sought:

- Waiver of finance charges of ₹6.3 lakhs already paid, as they are unreasonable and have not reduced my outstanding.

- Conversion of the remaining principal dues (approx. ₹1–2 lakhs) into an EMI plan of 1–2 years at a fair interest rate.

- Immediate withdrawal of my account from third-party collectors until a resolution is finalized.

- Correction of my CIBIL/credit score impact caused due to unfair practices.

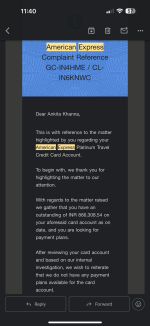

- American Express admitted on call that they have paused financial relief.

- My repeated written escalation to the Nodal Officer has not been responded to.

- RBI’s Integrated Ombudsman Scheme and NBFC Fair Practices Code mandate fair treatment of customers.

I request the Consumer Forum to kindly intervene and direct American Express to provide me fair restructuring, stop harassment through third-party collectors, and ensure justice in line with RBI’s regulations.