taherkarbalai

New member

- Bank Name

- Kotak Mahindra Bank

- Loss Amount

- 102400

- Ratings

- 1.00 star(s)

I am Mr. Taher Cutleriwala, resident of Thane/Palghar, I do hereby serve you the following legal notice:

LEGAL GROUNDS AND RELIEF CLAIMED

I DEMANDS THE FOLLOWING:

FAILURE TO COMPLY with the above demands within 15 days of receipt of this notice shall constrain my client to initiate appropriate civil and criminal proceedings under applicable laws, including but not limited to the Consumer Protection Act, 2019, Information Technology Act, 2000, and Indian Penal Code (Section 420, 406, 468), and also approach the Banking Ombudsman and the RBI, at your sole cost and risk

- I was enticed & asked to apply for Visa Cashback Credit Card by your bank, Kotak Mahindra Bank Ltd., on 02 November 2025. This was her first ever credit card, and it remained undelivered and unused by me ever.

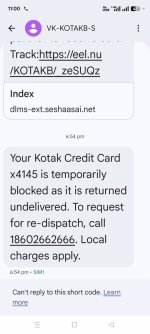

- On 13 November 2025 at around 1.30 PM, I received a phone call from a Deepak Sharma (96258 00864) impersonating courier department of Kotak Mahindra Bank, stating that the credit card needed activation and that the credit limit to be set before hand delivery.

- The fraud person directed me to the Kotak Bank App and manipulated to share an OTP under false pretenses. Immediately thereafter, 2 transactions of INR 51,200 were carried out without any authorization or approval to Amanzon Pay India Private Ltd.

- Upon realizing the fraud, I immediately called Kotak customer center number,raised the dispute, blocked the card and lodged a on-line FIR with the National Cybercrime Portal (Complaint No. 31911250216820 dated 13 November 2025), following which the complaint was forwarded to Achole Police Station.

- Investigations revealed that the amount was fraudulently used in Bangalore. This clearly establishes that the transaction was unauthorized and fraudulently induced, falling under the category of identity theft and social engineering.

- I was called by Kotak bank to issue a replacement card that i denied.

- Despite being made aware of the fraud and an FIR being filed, Kotak bank has continued to demand the payment of INR 1,02,400 and even attempted to convert the amount into EMIs, which clearly reflects misconduct and deficiency of service on part of the bank.

- It is both concerning and suspicious that fraudsters were aware of the issuance of a brand-new card — this points to a potential data leak or insider involvement, for which the bank is squarely liable.

LEGAL GROUNDS AND RELIEF CLAIMED

- Under Reserve Bank of India (RBI) Circular - DBR.No.Leg.BC.78/09.07.005/2017-18 dated July 6, 2017, regarding Limiting Liability of Customers in Unauthorized Electronic Banking Transactions, a customer shall have zero liability in cases where the unauthorized transaction occurs due to contributory fraud/negligence/deficiency on the part of the bank or a third party, even when the customer notifies the bank after seven working days.

- Further, in Punjab National Bank v. Leader Valves Ltd. (2008) 8 SCC 258, the Hon’ble Supreme Court held that banks are under a statutory and contractual obligation to ensure safety of customers' funds.

- In ICICI Bank Ltd. v. Shanti Devi Sharma, the National Consumer Disputes Redressal Commission (NCDRC) held that the bank cannot recover amounts arising from fraudulent transactions if the customer has taken due care and reported promptly.

- Under Section 43 of the Information Technology Act, 2000, any unauthorized access or fraud involving personal data and credentials, like OTPs, is punishable, and the victim is entitled to compensation from the entity responsible.

I DEMANDS THE FOLLOWING:

- Immediate reversal of the said fraudulent transaction amount (INR 1,02,400) and waiver of the falsely accrued outstanding amount .

- A written confirmation from Kotak Mahindra Bank Ltd. that no adverse action will be taken against my CIBIL score or any other credit reporting agency.

- A formal explanation as to how unauthorized third parties obtained information regarding the issuance of the said card.

- Compensation for mental harassment, negligence, and failure of due diligence on part of the bank, as per RBI and IT Act guidelines.

FAILURE TO COMPLY with the above demands within 15 days of receipt of this notice shall constrain my client to initiate appropriate civil and criminal proceedings under applicable laws, including but not limited to the Consumer Protection Act, 2019, Information Technology Act, 2000, and Indian Penal Code (Section 420, 406, 468), and also approach the Banking Ombudsman and the RBI, at your sole cost and risk