Santosh Kumar

New member

- Institute Name

- BYJUS

- Customer Care Number

- Not contactable

- Loss Amount

- 23500

- Ratings

- 4.00 star(s)

- Opposite Party Address

- BYJUS, INCRED Finance

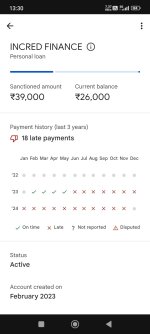

I have cleared the Byjus subscription settlement Loan amount to BYJUS think & learn through UPI payment for my daughter taken in Feb 2023 & as per their notice period, the subscription settlement amount was 30000 including 2 EMI x 3250 for (total subscription amount was 39000) after communication with their customer care, grievance cell but they not provided me the NOC after many following, after that no any EMI was deducted from INCRED Finance in April 09 2023.But when in December 2024 end i applied for Home Loan it was showing 26000 active loan for INCRED Finance in CIBIL record with low CIBIL score was 628 due to that my home loan has cancelled from HDFC Bank which I have cleared already & evey month end they are mailing my active loan nov 2024 to 25 Jan 2025.

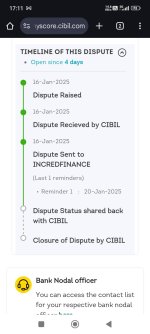

While despute raise online to cibil team which they sent to INCRED Finance team & closed it by replying that INCRED Finance has telling the active loan, Before it i mailed & tried to contact the Byjus customer care, grievance cell, mobile no but no any response received.so i request you to verify according to my attached documents & try to help me & get justice.

me & get justice.

While despute raise online to cibil team which they sent to INCRED Finance team & closed it by replying that INCRED Finance has telling the active loan, Before it i mailed & tried to contact the Byjus customer care, grievance cell, mobile no but no any response received.so i request you to verify according to my attached documents & try to help

Attachments

-

52f17752-1c37-41aa-a9bb-7977445fce85 (2) (1).pdf44.1 KB · Views: 0

-

52f17752-1c37-41aa-a9bb-7977445fce85 (2) (1).pdf44.1 KB · Views: 0

-

01681140005739_1735991476223.pdf68.4 KB · Views: 0

-

Screenshot_2025-01-04-13-30-44-229_com.google.android.apps.nbu.paisa.user.jpg69.3 KB · Views: 0

Screenshot_2025-01-04-13-30-44-229_com.google.android.apps.nbu.paisa.user.jpg69.3 KB · Views: 0 -

Screenshot_2025-01-22-19-19-48-342_com.google.android.gm.jpg86.5 KB · Views: 0

Screenshot_2025-01-22-19-19-48-342_com.google.android.gm.jpg86.5 KB · Views: 0 -

Screenshot_2025-01-22-19-19-41-171_com.google.android.gm.jpg90.2 KB · Views: 0

Screenshot_2025-01-22-19-19-41-171_com.google.android.gm.jpg90.2 KB · Views: 0 -

Screenshot_2025-01-20-17-11-43-553_com.android.chrome.jpg98.7 KB · Views: 0

Screenshot_2025-01-20-17-11-43-553_com.android.chrome.jpg98.7 KB · Views: 0 -

Screenshot_2025-01-20-17-11-33-983_com.android.chrome.jpg92.7 KB · Views: 0

Screenshot_2025-01-20-17-11-33-983_com.android.chrome.jpg92.7 KB · Views: 0 -

Screenshot_2025-01-20-17-11-17-070_com.android.chrome.jpg92.9 KB · Views: 0

Screenshot_2025-01-20-17-11-17-070_com.android.chrome.jpg92.9 KB · Views: 0 -

Screenshot_2025-01-20-17-11-10-281_com.android.chrome.jpg93.8 KB · Views: 0

Screenshot_2025-01-20-17-11-10-281_com.android.chrome.jpg93.8 KB · Views: 0